If you would ask “Is Berkshire a good stock,” most people would respond yes. I mean after all, Warren is considered by most to be the greatest investor ever.

However…

Pretend for a moment that you had the wisdom to buy Berkshire at the absolute bottom of the financial crisis—March 2009. You confidently enter your trade for one share and got filled at $86,700.

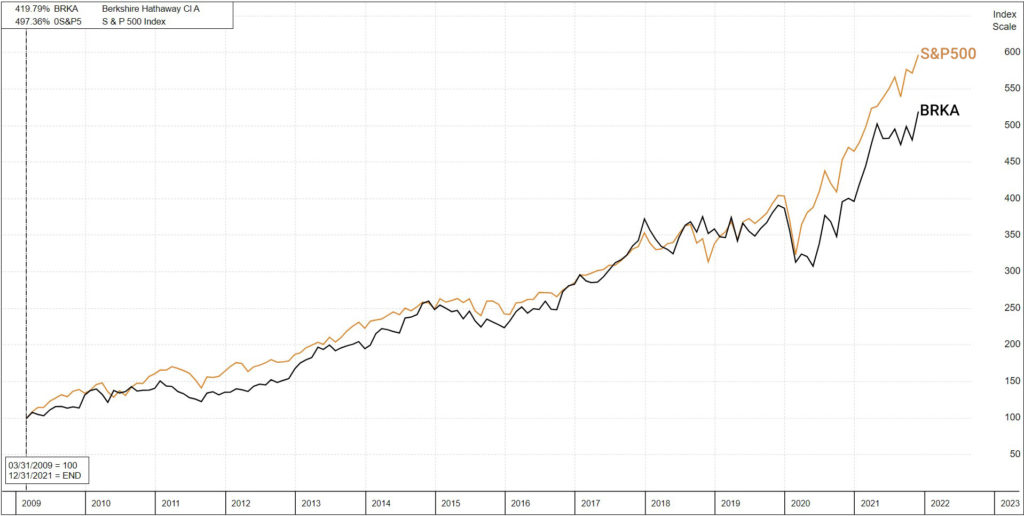

Considering the stock now trades near its all-time high of $450,622—up 420% at the end of 2021—you might be thinking to yourself that it was a great investment. Something to brag about on the golf course.

Would you be surprised to learn that Berkshire has underperformed the S&P 500 Price Index over that same period?

What makes it even worse is Berkshire doesn’t even pay a dividend!

In fact, the only class of Berkshire shareholders who are ALL ahead of the S&P 500 are shareholders who bought and held before 2007! Meaning anyone who has purchased and held the stock post 2007 has lagged the S&P 500.

Take a look at how Berkshire has lagged the S&P since the market bottom in March 2009:

An investor would have been much better off with the S&P during this period and would not have taken the asymmetrical risk of owning the stock—even if it is Berkshire.

Many of the comfortable stocks we all know such as IBM or AT&T are of the same vein: they lag the indexes over the long-term and offer little potential for investors. One can say the same for Berkshire.

Many investors fail to recognize that there is a lifecycle to stocks. There are only certain periods when they should be a part of your portfolio. Measuring your holdings against the S&P can help weed out undesirable investments. When they start to trade with the market, or worse lag, investors should consider selling.