Our Stock Profiles show how we use our research and analysis to identify unheralded—even boring—stocks that will emerge as true market leaders and achieve breakout growth.

If you’d like us to email you our newest Stock Profiles as we publish them, please…

Their business started out years ago providing a mail-back service for unused medication and, over time, grew into providing onsite containers in medical offices and pharmacies. Another revenue stream is their route-based business of onsite medical-waste collection.

Their business started out years ago providing a mail-back service for unused medication and, over time, grew into providing onsite containers in medical offices and pharmacies. Another revenue stream is their route-based business of onsite medical-waste collection.

Let’s be honest – it’s really a BORING company – something you wouldn’t brag about owning on the golf course.

What got us excited about the stock last fall was that their seasonal flu business (collecting used vaccine needles) had the potential to be a natural winner in connection with the COVID-19 vaccine…a scalable event.

Most recently, Sharps reported their latest quarterly earnings: Sales were up +164% and earnings were up +500% when compared to the prior year!

We viewed the vaccine as a potential catalyst for substantial near-term growth in the company’s earnings and value.

Although we bought the name early, the stock quickly built momentum after the vaccines were announced in November 2020.

Our analysis showed a considerable “mismatch” between current price and the future price implied by anticipated growth in earnings and value. And, in fact, price growth rapidly gained momentum…

We’re not suggesting that all our ideas work this way, and Sharps Compliance is certainly not a “buy” now. But this Stock Profile does illustrate how a combination of fundamental and price-action analyses can be so effective in identifying a boring stock that is about to take off on a substantial far-from-boring growth trajectory.

ClearPoint Neuro is based in California and is a medical device company that has developed a platform for performing minimally invasive surgical procedures in the brain.

What makes ClearPoint so unique from other competitors: their ClearPoint system is the only surgical platform that provides real-time MRI guidance for a range of minimally invasive procedures in the brain. This ultimately provides a never-before surgical option for patients with neurological disorders such as Epilepsy, Parkinson’s and ALS, among others.

Although still in its infancy, ClearPoint’s technology has a multitude of other applications, including treatments for gene therapy and drug delivery, expanding its total addressable market.

Over the past several years, its case volume has grown meteorically: at a +30% CAGR. ClearPoint has formed partnerships with leading companies such as Siemens.

From our research, we believe the company has a scalable business model, especially considering its drug delivery business.

Last quarter, they reported continued momentum with ClearPoint and a 162% increase in biologics and drug delivery revenue, which further supported our thesis of a “mismatch” in current price to future price. We believe these developments were an inflection that indicated substantial near-term growth in the company’s earnings and value.

To be sure, this stock was more on the speculative side of things. What’s more, we’re not suggesting that all our ideas work this way, or that ClearPoint is still a “buy.” But this Stock Profile does illustrate a point: how a combination of fundamental and price-action analyses can be so effective in identifying a stock that is about to take off on a substantial growth trajectory.

What makes Intellia Therapeutics so unique from other biotech companies: they use CRISPR technology that enables alteration of DNA and the modification of gene function, which ultimately can cure many diseases and conditions such as Leukemia.

Some experts predict that the CRISPR technology is so powerful – to the point where genetic disorders may become a thing of the past.

Over the past several quarters, collaboration revenues have grown at an incredible pace…+68% CAGR to be exact…and partnerships have been formed with leading biotech companies Regeneron and Novartis…an inflection point that got us excited about buying the stock.

We believe that these near-term favorable catalysts indicated a growth in the company’s earnings and value.

Last quarter they reported continued momentum in multiple trials, including the likelihood of dosing their first patient. We bought the stock after this development because we believed it reached an inflection point and a “mismatch” in price.

To be sure, this stock was more on the speculative side of things. What’s more, we’re not suggesting that all our ideas work this way or that Intellia Therapeutics is a “buy” now. But this Stock Profile does illustrate a point: how a combination of fundamental and price-action analyses can be so effective in identifying a relatively unknown stock that is about to take off on a substantial growth trajectory.

IES is based in Houston and is a holding company for industrial products and infrastructure services.

They started out as a group of electrical contractors years ago, but in the last decade they have diversified by acquiring different business lines…very similar to a roll-up.

They now have four different business lines: Communications, Residential, Infrastructure Solutions, and Commercial and Industrial. Residential is by far the fastest growing.

Let’s be honest – it’s really a boring company. But when you look under the hood…

Over the past three quarters, year-over-year EPS has accelerated: 0%, +39%, and +81%. And their annualized EPS growth rate over the past 5 years is +22%!

What got us particularly interested in the stock was the company’s SIGNIFICANT backlog, a factor that provides investors with a great deal of comfort that business is strong. Then, this past August, the company announced strong Q2 numbers. We viewed the backlog plus these numbers as catalysts that strongly indicated substantial near-term growth in the company’s earnings and value.

We bought the stock after the Q2 earnings were announced because we believed it had reached an inflection point. Our analysis showed a considerable “mismatch” between current price and the future price implied by anticipated growth in earnings and value. And price growth rapidly gained momentum. See for yourself…

We’re not suggesting that all our ideas work this way. And of course, this is old news now. But the purpose of this Stock Profile is to show how a combination of fundamental and price-action analyses can be so effective in identifying a stock that is about to take off on a substantial growth trajectory.

Novocure is a medical products company developing novel therapy treatments for cancerous tumors including brain cancer.

What makes Novocure so unique: they use electric fields tuned to specific frequencies to disrupt cell division, which ultimately inhibits tumor growth and potentially causes cancerous cells to die.

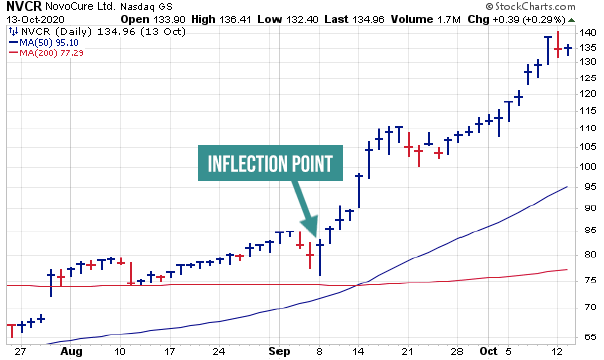

Over the past several quarters, sales have grown at a blistering pace…+39% CAGR to be exact. What’s more, it is just becoming profitable—an inflection point, which is what got us excited about buying the stock.

Their Optune treatment for glioblastoma (GBM), a form of brain cancer, has been used to treat over 16,000 patients. And it just received regulatory approval for the treatment of GBM in China.

We viewed this positive development as a catalyst for substantial near-term growth in the company’s earnings and value.

Last quarter, Novocure reported terrific earnings and we tactically bought shares after a pullback in stock price. Our analysis showed a considerable “mismatch” between current price and the future price implied by anticipated growth in earning and value. Let’s take a look at the results…

We’re not suggesting that all our ideas work this way or that Novocure is a “buy” now. But, while this story is “past tense,” its message is timeless: how a combination of fundamental and price-action analyses can be so effective in identifying a low-profile stock that is about to achieve breakout performance.

Founded in 1951, Kulicke & Soffa is a Pennsylvania-based semi-conductor manufacturer specializing in back-end electronic assembly solutions for automotive, consumer, communications, computing, and industrial markets.

Founded in 1951, Kulicke & Soffa is a Pennsylvania-based semi-conductor manufacturer specializing in back-end electronic assembly solutions for automotive, consumer, communications, computing, and industrial markets.

Key underlying growth drivers for KLIC include Smartphone, Internet-of-Things (IoT), 5G, LED Lighting, and cloud computing.

What got us excited about the stock was the fundamental driver that the semiconductor industry is in a severe shortage, which naturally increases revenue but more importantly – EARNINGS. And, earnings drive stock appreciation.

Over the last three quarters, year-over-year EPS has accelerated +250%, +143%, and +197%…which includes an 86% YOY growth in revenue last quarter alone!

We viewed the backlog plus these numbers as the catalysts that indicated substantial near-term growth in the company’s earnings and value.

We bought the stock because we believed it had reached an inflection point. Our analysis showed a considerable “mismatch” between current price and the future price implied by anticipated growth in earnings and value. And price growth rapidly gained momentum. Take a look…

We’re not suggesting that all our ideas work this way or that Kulicke & Soffa is a “buy” now. The point of this Stock Profile is to illustrate how a combination of fundamental and price-action analyses can be so effective in identifying an under-the-radar stock that is about to take off on a substantial growth trajectory.

For emails of our upcoming Stock Profiles, as well as alerts about our latest ViewPoints articles and Actionable Stock Ideas, please fill in your name and email address, and “submit.”