Our Investment Strategy

We identify and invest in true market leaders before their major price advance

Every year there are certain stocks that dramatically outperform the market.

While these “true market leaders” are rare, our strategy is geared towards identifying them before each begins its major surge of appreciation.

The Core of Our Strategy: Understanding a Key Mismatch

In order to identify and invest in true market leaders before they’re discovered by the market, we seek to uncover the mismatch between:

- What most investors currently perceive about a company’s underlying business economics and earnings power, versus…

- The probable future earnings power that our strategy reveals.

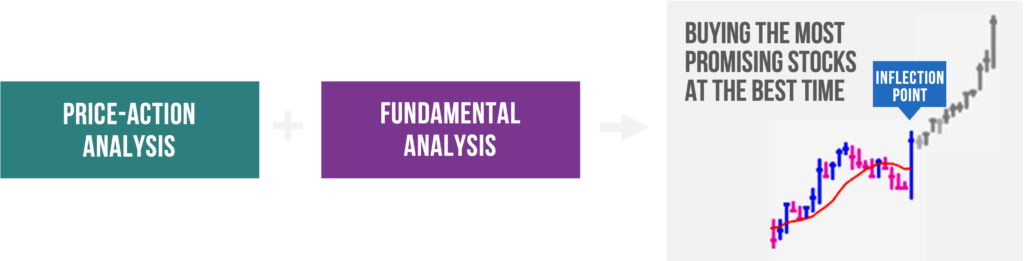

To find and evaluate these mismatches, we take advantage of two important and proven types of analyses that help us see the full investment picture.

Two Synergistic, Complementary Tools

Both are important together…

Price-action analysts can gauge near-term supply/demand dynamics.

But they’re typically unaware of the underlying economics that influence price.

Fundamental analysts may find compelling stories that can drive a stock’s price higher.

But they often forget they are dealing with the market—and its psychology.

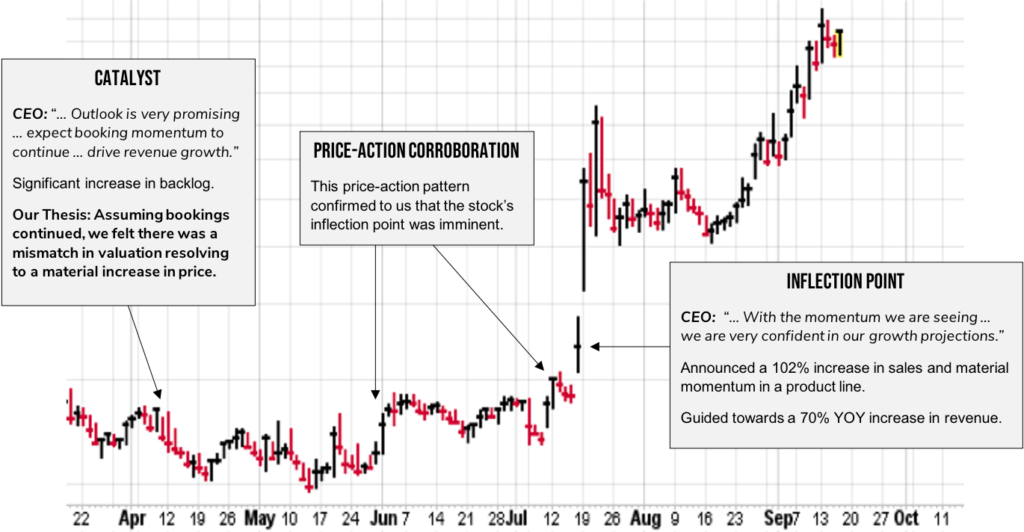

Identifying Compelling Catalysts

In our fundamental research we look for concrete information or events, called “catalysts,” that we believe will lead to substantial growth of a company’s earnings—and value—in the months and years ahead.

The Catalysts We Evaluate

MAJOR COMPANY NEWS

New products, markets or partners, or a report of earnings growth

SIGNIFICANT CHANGES AND TRENDS

Governmental, economic, legal, industry, health, military

THE ADVENT OF A DISRUPTIVE PRODUCT

That can serve a very large market

SCALABLE EVENTS THAT PROVIDE OPERATIONAL LEVERAGE

Our Goal

Identifying companies with clear, consistent pathways to future earnings growth…

Which is a key determinant of a company’s long-term business value…

And a prime attribute of a true market leader

Finding the Inflection Point

Once our fundamental research has established the near-term likelihood that a particular stock will begin a major price advance, we turn to price-action analysis to further corroborate its probability and zero-in on when it will happen.

Putting It All Together

Our synthesis of price-action and fundamental analyses puts us in excellent field position…